Here’s What The Bank Of Canada Says Is The Real Reason For The Housing Slowdown

Don’t blame government policy. We kind of did this to ourselves.

The report never uses the word “bubble,” preferring the more neutral-sounding term “froth,” but it paints a clear picture of housing markets where excessive enthusiasm led to runaway house price growth, followed by the inevitable snap-back once there weren’t enough buyers to keep the party going.

And while the mortgage stress test did play a role, it was a minor one, the BoC concluded.

A lot of things happened in 2016 and 2017 to slow down what was at the time an overheated housing market:

- British Columbia and Ontario introduced foreign buyers’ taxes

- Canada’s banking regulator, OSFI, progressively toughened mortgage lending rules

- The Bank of Canada began raising interest rates.

To get an idea of just which of these changes actually affected housing, and how, the BoC’s analysts analyzed “loan-level micro data to decompose movements in housing resales.” In other words, they attempted to track the actual flow of money through mortgage markets, to see how each change successively affected people’s decisions.

What they found was a housing market where prices grew way out of affordability range for buyers. Between 2015 and 2018, the rising cost of home ownership would have lowered annual home sales nationwide by a hefty 56,000, the BoC’s report estimated.

Only a fraction of that — 10,000 sales — would have been due to the mortgage stress test, the bank found. All the rest would have been due to rising prices and hikes to mortgage rates.

But Canada got lucky: The affordability crisis happened about the same time as a jobs boom, which pushed up incomes and increased demand for housing by almost enough to offset the jump in home ownership costs. Hence, a housing slowdown, but no bust.

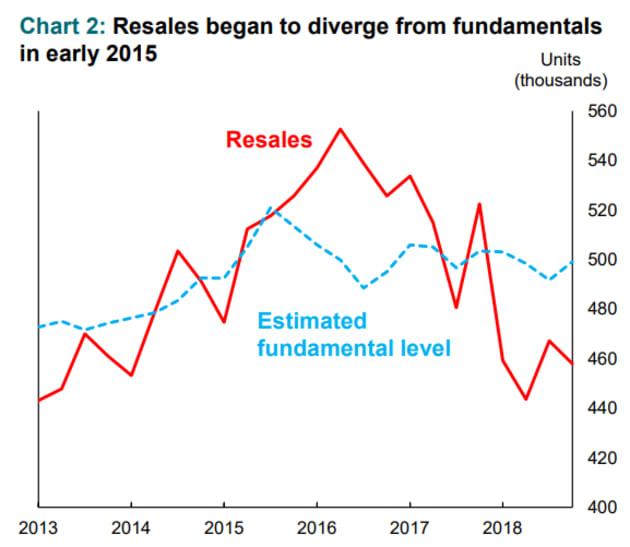

The BoC flagged another classic sign of a housing bubble: Around 2015 and 2016, Toronto and Vancouver saw a spike in home sales, well beyond what you would expect at that level of employment and income. The increase in sales in that time was 10 times as large as it should have been, given economic conditions, the BoC estimated.

“Much of the previous strength in resale activity was influenced by extrapolative expectations. … These expectations quickly faded following the policy measures,” the report stated.

In other words, people panicked. Expecting house prices to keep growing rapidly, they jumped into the market as soon as they could, and so further pushed up prices and home sales.

Then, when new taxes and mortgage rules took hold, expectations went from too optimistic to too pessimistic. Sales fell below where they should be, given economic fundamentals, and that’s where they remain today.

Much as we’d like to blame foreign buyers or government policy, it seems we kind of did this to ourselves.

“The housing market is currently in uncharted territory.”Bank of Canada, “Disentangling the Factors Driving Housing Resales,” April 2019

And a rapid rebound seems unlikely. The BoC’s report suggests sales will likely remain sluggish until prices align better with incomes.

But so far, affordability isn’t improving, or at least not much. Prices remain elevated even as sales remain weak, and a recent study from Zoocasa highlighted how extreme the problem has become: It estimates only the top 2.5 per cent of Vancouver’s earners, and the top 10 per cent of Toronto’s earners, could afford a detached home today. Only the top 25 per cent of earners in these cities can even afford a condo.

And, with household debt hitting yet another record high at the end of 2018, BoC deputy governor Carolyn Wilkins expects consumers to keep hitting the brakes on spending.

“When consumers are highly indebted — and yes, it’s a major vulnerability, it’s the number one financial vulnerability for the Canadian economy — at some point households may start to say, ‘I need to increase my savings’,” Wilkins told reporters at a press conference on Wednesday.

What that means for the housing market going forward is hard to guess, and even the Bank of Canada isn’t willing to go out on a limb. With new taxes and new mortgage rules working their way through the system, and high debt levels supported by a booming job market, we’ve got a brew on our hands no one has ever quite seen before.

The BoC’s report sums it up neatly, if not reassuringly: “The housing market is currently in uncharted territory.”

.jpg?width=600&name=Rate%20Table%20(April%201,%202019).jpg)